That way, there will be significantly fewer misunderstandings if you actually end up working together. Delegate responsibilities carefully: While having a detailed joint venture agreement is important, it’s still important to have a frank discussion with potential partners about who will do what and when.Of course, you’ll also need to make sure that a potential partner (or firm) has the operational experience, manpower, and capital to get the job done. It’s essential to make sure that both partners are on the same page involving ethical business practices, risk tolerance, timeliness, and other important factors. Be careful when selecting a partner: Choosing the wrong partner can sink a joint venture, while choosing the right one can help it skyrocket to success.

However, having certain structures in place may be able to reduce risk and prevent a bad situation from getting worse.

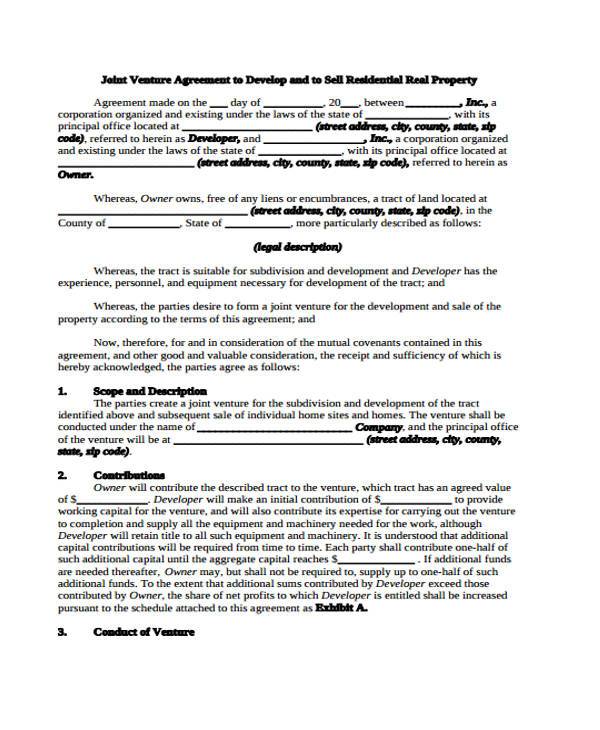

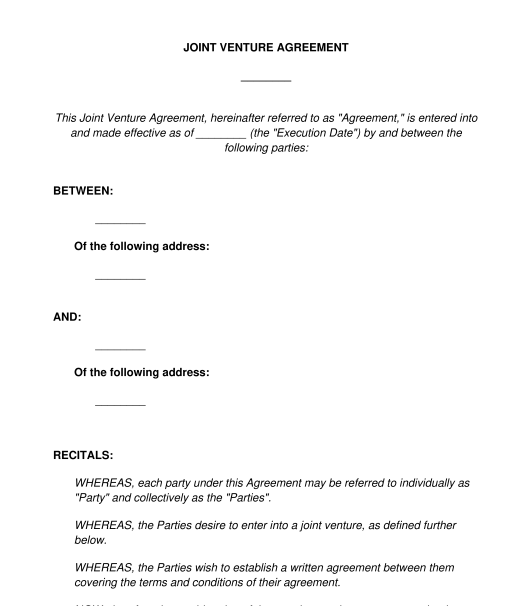

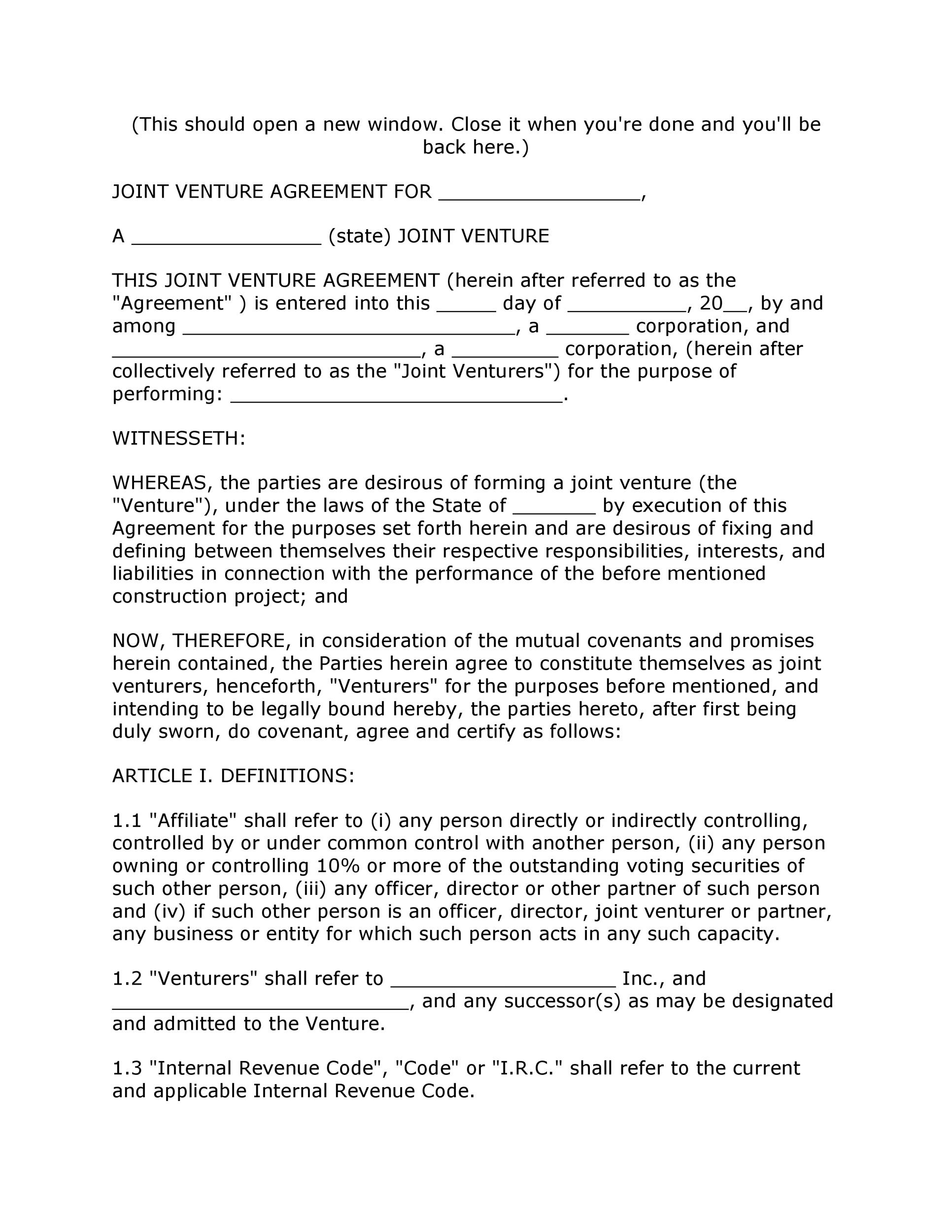

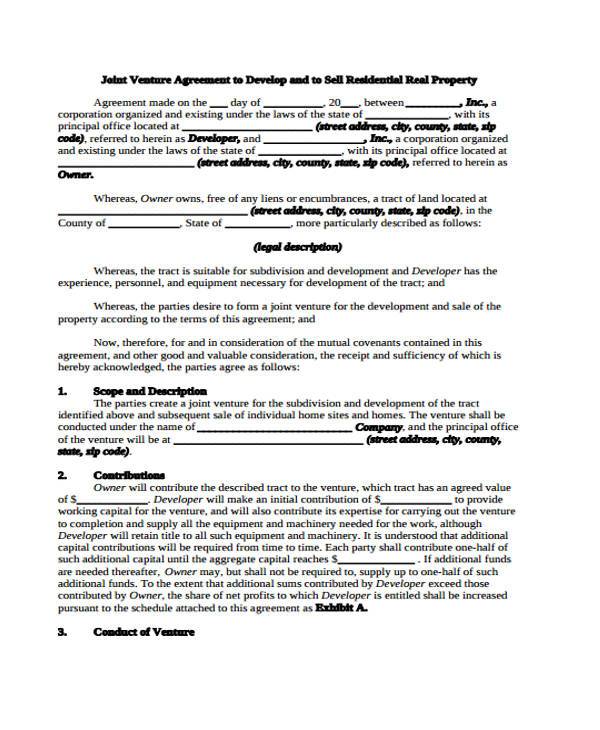

Contingencies and how various emergencies will be handled: Natural disasters, ‘acts of God’, lawsuits and other unforeseen events can easily derail a real estate investment or development project. Exit strategies: The exit strategy should detail the estimated timeline for the project exit, how it will be done, and under which circumstances a party can exit the agreement early. For instance, if the operating partner has a significant ownership stake, the capital partner may have the right to buy his stake after a certain period. Long-term ownership rights: The agreement should also detail who will be able to own the property after the primary investment period is over. In addition, the operational partner will typically be awarded certain fees. They will often be compensated in the form of a waterfall/promote structure, in which they will receive a proportionally larger share of the profits (called a promote) should the project exceed certain profitability hurdles. In many situations, the operating partner will take in a larger share of the profits due to their additional management responsibilities.  Profit splits/management responsibilities: The agreement should detail exactly how profits are split. In addition, the joint venture agreement should clearly state if the venture plans to take out a commercial real estate loan, and, if so, for how much. However, in some cases, the operational partner will not contribute anything, while the capital partner contributes 100% of the required capital. How much each party will contribute to the venture: In most cases, a capital partner or partner(s) will contribute the majority of the capital to a project, while the operational partner will contribute a smaller stake. The plans and goals of the joint venture: This part of the agreement should detail the property that the JV plans to develop/acquire, and how will they do it. The most important factors to consider when forming a joint venture for commercial real estate are: To try to ensure that your joint venture partnership goes off without a hitch, you may want to consider following some of the best practices listed in the Joint Ventures in Commercial Real Estate article.

Profit splits/management responsibilities: The agreement should detail exactly how profits are split. In addition, the joint venture agreement should clearly state if the venture plans to take out a commercial real estate loan, and, if so, for how much. However, in some cases, the operational partner will not contribute anything, while the capital partner contributes 100% of the required capital. How much each party will contribute to the venture: In most cases, a capital partner or partner(s) will contribute the majority of the capital to a project, while the operational partner will contribute a smaller stake. The plans and goals of the joint venture: This part of the agreement should detail the property that the JV plans to develop/acquire, and how will they do it. The most important factors to consider when forming a joint venture for commercial real estate are: To try to ensure that your joint venture partnership goes off without a hitch, you may want to consider following some of the best practices listed in the Joint Ventures in Commercial Real Estate article.  Natural disasters, ‘acts of God’, lawsuits and other unforeseen events can easily derail a real estate investment or development project. While this can lead to cost savings, in some cases, what benefits these affiliated companies may not be best for the performance of the investment. In many cases, the operational member of a joint venture may also be a property manager or a general contractor, and, in many cases, they will be using their own company to do a significant amount of work involving the property. Choosing the wrong partner can sink a joint venture, while choosing the right one can help it skyrocket to success. Some of the risks associated with joint venture financing for commercial real estate include:

Natural disasters, ‘acts of God’, lawsuits and other unforeseen events can easily derail a real estate investment or development project. While this can lead to cost savings, in some cases, what benefits these affiliated companies may not be best for the performance of the investment. In many cases, the operational member of a joint venture may also be a property manager or a general contractor, and, in many cases, they will be using their own company to do a significant amount of work involving the property. Choosing the wrong partner can sink a joint venture, while choosing the right one can help it skyrocket to success. Some of the risks associated with joint venture financing for commercial real estate include:

Without proper planning, a joint venture can easily be a sand-trap, in which one (or both) parties can lose valuable investment capital and even expose themselves to serious liability. Joint ventures can be extremely rewarding for all parties involved, but they also come with certain risks.

0 kommentar(er)

0 kommentar(er)